Award Setup

As part of your setup and integration with Wageloch, we need to know how you pay your staff according to either:

- Your industry's legislative award.

- Your Enterprise Agreement (EA or EBA).

- Individual Flexibility Arrangement (IFA) that's been agreed upon with your employees.

The detail you provide is manually programmed into Wageloch's award interpreter; the more information you provide the better.

This award information is how your timesheets are automatically calculated for submission to your payroll, based on the shifts confirmed each day.

We have the ability to make very intricate award rulings such as allowances, afternoon/night/morning rates - let us know what you need!

To speak to our Helpdesk team about your award and any relevant changes, please contact Helpdesk.

DISCLAIMER

Wageloch (Lochsoft Pty Ltd) does not in any way warrant or represent that its award interpreter provides correct interpretation of the relevant award.

The customer must notify Wageloch (Lochsoft Pty Ltd) of any changes required to the award rules used by the award interpreter.

It is the responsibility of the customer to check that the amounts calculated by the software are correct.

Process

- Once Wageloch has received your signed agreement, your account is assigned to an implementation specialist.

- Your implementation specialist will make first contact by giving you a call and welcoming you to Wageloch.

- During this call, they will find out more about you, your business and needs.

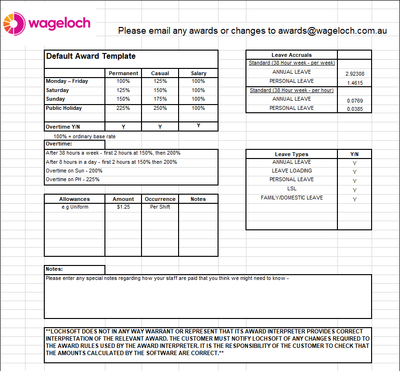

- The specialist will discuss our award template with you; an editable Excel spreadsheet that provides a rough guide of the award information we need to formulate your timesheets.

- When you receive the emailed spreadsheet, please consult your award/EA/IFA and fill this template out to the best of your ability.

- If you have multiple awards, you're welcome to duplicate and modify and needed.

- Once completed, please send your template/s back to your implementation specialist, or to awards@wageloch.com.au.

- Should your specialist have any questions or concerns, they will contact you directly to clarify.

- Once completed, you'll move to the next step in the Integration Timeline

What information do I include?

In the template, you'll notice some simple pay group columns such as Casual, Permanent and Salary as well as rows for Monday - Friday, Saturday, Sunday, Public Holidays and Overtime.

There are also some multiplier percentages, such as 100%, 125%, 150%, etc.; these are all simply examples of things we need to know according to your award.

Example: Specify the pay groups, and how the award dictates their rate of pay. You're able to add more columns and rows to add more detail to your pay groups and daily breakdown.

| Casual | Permanent | Salary | |

|---|---|---|---|

| Mon - Fri | 125% | 100% | 100% |

| Saturday | 150% | 125% | 100% |

| Sunday | 175% | 150% | 100% |

| Public Holidays | 250% | 225% | 100% |

| Overtime | Y | Y | N |

Under this table, you will see a field to indicate how your overtime calculates, which can also depend on your pay frequency.

- Does overtime occur after 38 hours a week/76 hours a fortnight?

- Does it happen daily after a specified amount of hours in a shift?

- How does it pay? (i.e. first 2 hours overtime 150%, overtime 200% thereafter)

This information is core to ensuring your timesheets generate correctly to speed up your payroll process, improve accuracy and reduce manual adjustments.

It's not set in stone; should something not work out correctly during your implementation stages, we can edit at any point in time.

Notes

During this process it is important to be aware of differences between:

Full-time employment vs. Salary

- Permanent full-time employees are paid for all hours they work, are entitled to penalty rates and overtime.

- Salaried employees only ever get paid their contracted hours; no more, no less, are not entitled to penalty rates or overtime.

Penalty rates vs. Overtime

- Penalty rates are a multiplier of the base rate, which attracts leave accruals (for permanent and salary) and superannuation.

- Overtime is exempt from superannuation and does not accrue leave.

Need Help?

Not sure of your award, or is there something not quite making sense?

We always recommend to speak to your nominated HR department, or contact FairWork Australia for guidance.

If you're not sure what to do with the award template, please don't hesitate to speak with your implementation specialist directly, or contact the Wageloch Helpdesk on (08) 7123 2993 or email

![]()

![]()