Difference between revisions of "Creating Pay Items"

(→Factor) |

|||

| Line 18: | Line 18: | ||

===Factor=== | ===Factor=== | ||

When initially building your award, your implementation manager will request for this information, and how you wish to calculate the pays. | When initially building your award, your implementation manager will request for this information, and how you wish to calculate the pays. | ||

This will either be a multiplier of a rate (1.0x, 1.5x, etc.) or a fixed dollar rate ($1.00, $13.45, etc). | This will either be a multiplier of a rate (1.0x, 1.5x, etc.) or a fixed dollar rate ($1.00, $13.45, etc). | ||

<div style="border-left: 4px solid orange; padding: 0.5em;"> | <div style="border-left: 4px solid orange; padding: 0.5em;"> | ||

Latest revision as of 05:44, 31 August 2025

Pay Item Creation

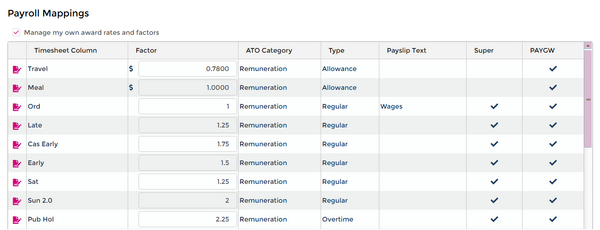

Your timesheet columns created in back end of Wageloch will determine the availability of the pay items you can create.

- Click the Settings cog, top right

- Select Payroll >> Payroll Mappings

- You'll be presented with a screen that shows you: Timesheet Column, Factor, ATO Category, Type, Payslip Text, Super and PAYGW.

Lets look into these a bit further.

Timesheet Column

Timesheet column is the name that we've given to this item in the award build. This is what will be visible in your reports in Wageloch when running Timesheet, Job Costing or other similar reports in the main Rostering, Time and Attendance system.

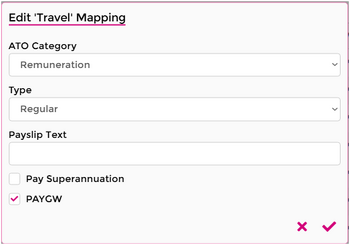

To access the setup relating to the other columns in your Payroll Mappings, click the ![]() Edit icon on the left side.

Edit icon on the left side.

Factor

When initially building your award, your implementation manager will request for this information, and how you wish to calculate the pays.

This will either be a multiplier of a rate (1.0x, 1.5x, etc.) or a fixed dollar rate ($1.00, $13.45, etc).

Tip: You can tick Manage my own award rates and factors to update and control these yourself, instead of requiring Helpdesk to update these for you!

ATO Category and Types

You will have the ability to set the reporting type that appears for the ATO; it's important to have this set correctly to avoid issues with taxation or superannuation.

Don't forget to specify whether these pay items will be needing to Pay Superannuation and are reported on the PAYGW summary.

Your options are:

| Remuneration | Deduction | Fringe Benefit |

|---|---|---|

| Regular | Fees | |

| Overtime | Workplace Giving | |

| Bonus or Commission | Child Support Garnishee | |

| Directors Fees | Child Support Deduction | |

| CDEP | ||

| Leave | ||

| Allowance | ||

| Salary Sacrifice | ||

| Lump Sum | ||

| Employment Termination Payment (ETP) |

Info: For more information about Fringe Benefits, please visit ATO.gov.au - Fringe Benefits