Difference between revisions of "Wageloch Payroll: How to Process Pays"

From Wageloch Wiki

| Line 72: | Line 72: | ||

* Click '''Save''' to finish | * Click '''Save''' to finish | ||

* Click '''Close''' to return to the pay run. | * Click '''Close''' to return to the pay run. | ||

[[File:Payrun-addstaff.png|500px]] [[https://wiki.wageloch.com.au/index.php/File:Addemployee-payslip.png|500px]] | [[File:Payrun-addstaff.png|500px]] [[https://wiki.wageloch.com.au/index.php/File:Addemployee-payslip.png|500px]] | ||

Revision as of 05:14, 31 August 2025

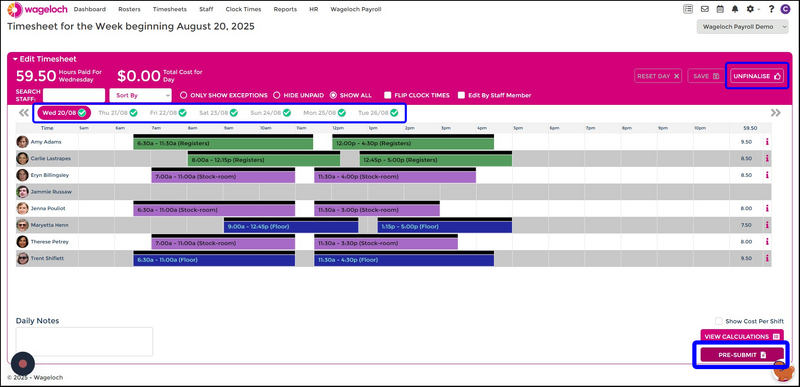

The timesheet submission process for Wageloch Payroll remains the same, whether you're a business owner completing your own payroll, or a site manager submitting timesheets to your Payroll team.

- Open your current timesheet

- Ensure all timesheet days are Finalised with a green tick

- Click Pre-Submit

- Your Pre-Submit timesheet summary report will generate

- Please check this information thoroughly.

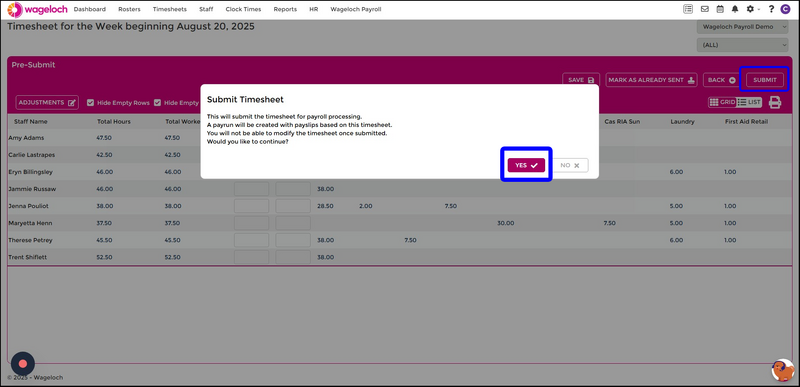

- When you're ready to proceed, click Submit.

- Confirm the prompt, acknowledging your timesheet will be submitted for processing.

- Once completed, you'll be either:

- Notified the timesheet was submitted successfully, OR

- Be redirected to Wageloch Payroll to start your submission.

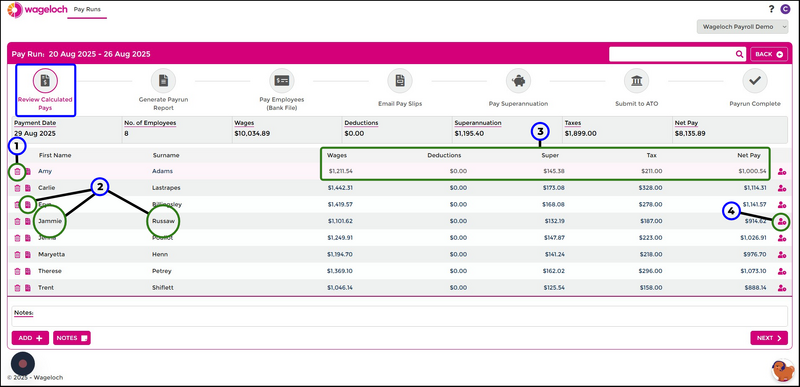

Stage 1: View Calculated Pays

This screen will allow you to:

- Click the Page icon or employee's name to edit their payslip (1)

- Click the Trash icon to delete an employee from this pay run (2)

- See the summary of Gross Wages, Deductions, Superannuation, Tax and Net Pay. (3)

- Click the People icon to view the timesheet that was submitted. (4)

- At the bottom of this screen, you will have a Notes button (5).

This will grant you the ability to add a note that is visible to all staff on their payslip.

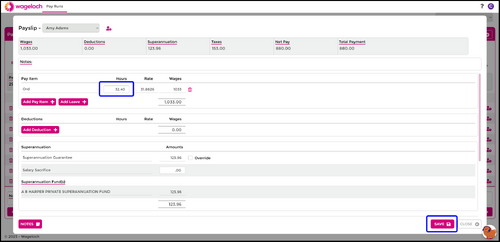

View/Adjust Pay Slip

- After clicking on the Page icon or the employee's name, you'll be presented with their payslip.

- This will show the employee's gross and net wages, alongside superannuation and tax across the top.

- You will be able to see the calculations for the employee's pays based on the hours in the timesheet and award configuration.

- Further down the page, you'll see any automated deductions, superannuation, salary sacrifice and tax withheld.

- There is an option in the bottom left to Add Note, which is only visible to this employee on their pay slip.

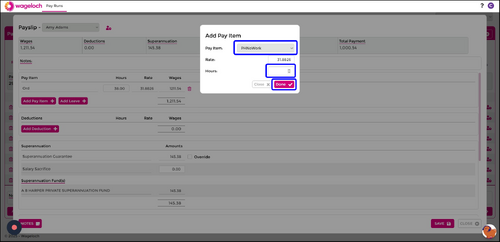

Add Pay Item or Add Leave

- If you're missing some hours or need to backpay an employee, use the Add Pay Item or Add Leave buttons.

- Select the appropriate Pay Item from the drop menu

- The Rate is typically calculated by the award setup and/or the employee's hourly rate on their staff card.

- Enter the Amount of hours, units or dollars, depending on the requirement.

- Click Done to save.

- Any automatic calculations like tax will update accordingly, but you can Override if needed

- Click Save to finish

- Click Close to return to the pay run

If you wish to edit a pay item that already exists, simply adjust the **Hours** field to add or remove hours as required.

- Click Save to finish

- Click Close to return to the pay run.

- Use the Notes button, bottom left to add a unique message for this employee.

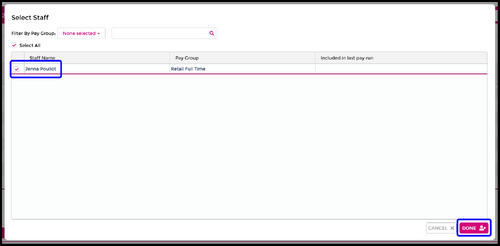

Add Employee to Payrun

- On the pay run screen, click the Add button, bottom left

- Select the employee to add into the pay run

- Click Done to add

- You'll immediately be presented with the employee's pay slip

- Proceed to add any pay items, leave, allowance and hours.

- Click Save to finish

- Click Close to return to the pay run.

[[1]]

[[1]]

Add Note for All Staff

To add a Note visible to all employees on their payslip:

- On the Pay Run screen, click the Notes button (bottom left)

- Add the message you wish to attach

- Click OK to save.

- This will now be visible at the bottom of the pay run.