Difference between revisions of "Wageloch Payroll"

| Line 71: | Line 71: | ||

* Follow the steps for your preferred notification method. | * Follow the steps for your preferred notification method. | ||

* Click Done to finish. | * Click Done to finish. | ||

[[File:Screenshot 2025-08-19 174614.png|500px]] | |||

* Please select if you are: | * Please select if you are: | ||

| Line 76: | Line 78: | ||

** A tax agent | ** A tax agent | ||

** A BAS agent | ** A BAS agent | ||

[[File:Screenshot 2025-08-19 175142.png]] | |||

<br> | <br> | ||

====Organisation Details==== | ====Organisation Details==== | ||

Revision as of 08:22, 19 August 2025

This guide will cover the general setup of Wageloch Payroll, it’s usage and processes when paying staff.

Wageloch Payroll is our newest product; we may be making changes as time progresses and we’ll update information in this guide.

Background Configuration

Whether you're a new or existing client with Wageloch implementing Payroll for the first time, there's always a little bit of setup required in the back end of our system.

While most of this information will be based on your award setup, we will need to know of any requirements to pay:

- Allowances (car, phone, uniform, travel, etc.)

- Deductions (child support, salary sacrifice, novated lease if not direct debited)

- Bonuses

- Backpay or Redundancy

Please let your Wageloch implementation manager know of your needs to ensure this is setup correctly.

Note: If you're using an existing payroll system and would like to complete parallel runs, please let us know!

Security

To use Wageloch Payroll, there are specific security requirements that must be enabled to grant access.

These permissions can be granted by Wageloch to Super Users, and Super Users to Admin users. Users that have restrictions (i.e. Non-Admin) will not have the ability to use Wageloch Payroll.

To see more on creating new users and setting permissions, please click Users & Security

Enabling Payroll Access

- Click the Settings cog, top right

- Select Security from the menu

- In the User Email field, select the email address to update.

- Tick the box for Payroll

- Click Save to finish; this user will have access to Payroll on next login.

<<<SCREENSHOT>>>

Enabling Multifactor Authentication

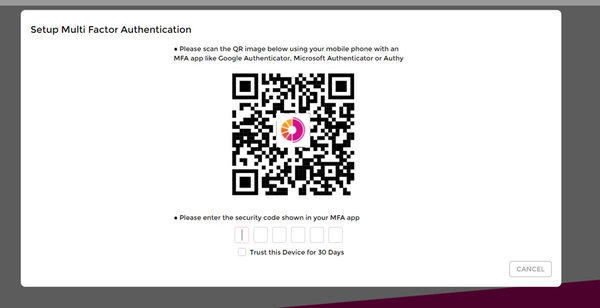

All users that intend to use Wageloch for digital onboarding, HR or Payroll are required to use Multifactor Authenticator for an additional layer of security.

You'll need an auth app like Google Authenticator, Microsoft Authenticator or Authy.

Warning: Scanning the QR code with your camera will generate a once off code, but you'll experience issues logging in every time thereafter. Use an authenticator app!

- In your browser navigate to https://app.wageloch.com.au/Login and login using your credentials

- Click on your initial in the top right and select “Manage your Wageloch User account”

- Have your mobile phone ready with your authenticator app open.

- Set the toggle under Security >> Multi Factor Authentication to Y

- You will now be shown a QR Code, please use your authenticator app on your mobile phone to scan the QR code and setup MFA.

- You will need to enter the code listed in your phone to authorise and log in to Wageloch, You can select to “Trust this device for 24 hours"

Connection Settings

- Click the Settings cog, top right

- From the menu, select Payroll >> Payroll Connection

- Here we will see three tabs; ATO STP Settings, Bank Details, Transfer BMS ID.

All information in this area is required and cannot be left blank or skipped.

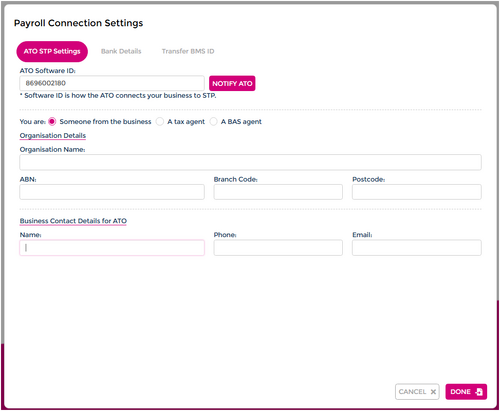

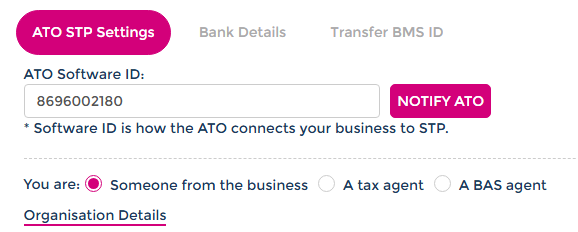

ATO STP Settings

ATO Software ID

- This is Wageloch's unique ID and will be automatically generated for you.

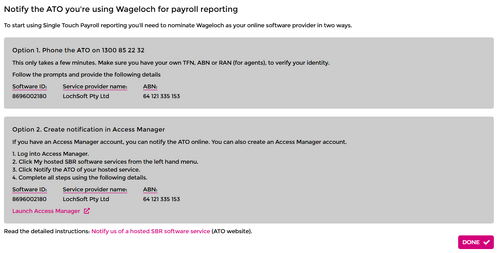

- Please click NOTIFY ATO

- You'll receive instructions on how to notify the ATO that your STP reporting will be completed through Wageloch Payroll.

- Follow the steps for your preferred notification method.

- Click Done to finish.

- Please select if you are:

- Someone from the business

- A tax agent

- A BAS agent

Organisation Details

- Organisation Name: Enter your business or trading name

- ABN: Enter your Australian Business Number (11 digits)

- Branch Code: Typically enter 1 unless otherwise specified

- Postcode: Enter the postcode for your suburb.

Business Contact Details for ATO

Enter the contact who will be authorizing pays to the ATO; Name, phone number and email address are required.