Difference between revisions of "Wageloch Payroll Connection Settings"

From Wageloch Wiki

(Created page with "=Connection Settings= * Click the <b>Settings</b> cog, top right * From the menu, select <b>Payroll >> Payroll Connection</b> * Here we will see three tabs; <b>ATO STP Settin...") |

|||

| (2 intermediate revisions by the same user not shown) | |||

| Line 13: | Line 13: | ||

[[File:Screenshot 2025-08-19 174353.png|500px|right]] | [[File:Screenshot 2025-08-19 174353.png|500px|right]] | ||

* This is Wageloch's unique ID and will be automatically generated for you. | * This is Wageloch's unique ID and will be automatically generated for you. | ||

* Please click NOTIFY ATO | * Please click '''NOTIFY ATO''' | ||

* You'll receive instructions on how to notify the ATO that your STP reporting will be completed through Wageloch Payroll. | * You'll receive instructions on how to notify the ATO that your STP reporting will be completed through Wageloch Payroll. | ||

* Follow the steps for your preferred notification method. | * Follow the steps for your preferred notification method. | ||

* Click Done to finish. | * Click '''Done''' to finish. | ||

* Please select if you are: | * Please select if you are: | ||

| Line 25: | Line 25: | ||

<span style="font-size:18px; font-weight:bold;">Organization Details</span> | <span style="font-size:18px; font-weight:bold;">Organization Details</span> | ||

<br> | <br> | ||

* Organisation Name: Enter your business or trading name | * '''Organisation Name:''' Enter your business or trading name | ||

* ABN: Enter your Australian Business Number (11 digits) | * '''ABN:''' Enter your Australian Business Number (11 digits) | ||

* Branch Code: Typically enter 1 unless otherwise specified | * '''Branch Code:''' Typically enter 1 unless otherwise specified; this is variable if you're running multiple businesses or branches under the same ABN. | ||

* Postcode: Enter the postcode for your suburb. | * '''Postcode:''' Enter the postcode for your suburb. | ||

<br> | <br> | ||

| Line 40: | Line 40: | ||

Inputting your bank details is super easy, and will be the existing or desired account that your wages will be paid from when we generate your ABA bank file. | Inputting your bank details is super easy, and will be the existing or desired account that your wages will be paid from when we generate your ABA bank file. | ||

* Account Name: Enter the name of your bank account as it appears on your statements | * '''Account Name''': Enter the name of your bank account as it appears on your statements | ||

* BSB and Account Number: Enter the BSB (Bank-State-Branch). This will always be a 6 digit number that specifies your bank and branch. | * '''BSB and Account Number''': Enter the BSB (Bank-State-Branch). This will always be a 6 digit number that specifies your bank and branch. | ||

* User Preferred Specification: Enter what you would like the transaction to appear as in your account. | * '''User Preferred Specification''': Enter what you would like the transaction to appear as in your account. | ||

* User Identification Number: This should be assigned to you by your bank to identify any transactions approved by you. | * '''User Identification Number''': Also known as an APCA number. This should be assigned to you by your bank to identify any transactions approved by you. | ||

<br> | <br> | ||

| Line 52: | Line 52: | ||

Your BMS ID can be found in different areas in different payroll systems, but you'll likely locate this on a payroll report or through your business' ATO Portal. | Your BMS ID can be found in different areas in different payroll systems, but you'll likely locate this on a payroll report or through your business' ATO Portal. | ||

* Log into the ATO's online services. | * Log into the '''ATO's''' online services. | ||

* Go to Employees >> STP reporting (agents go to Business >> STP reporting). | * Go to '''Employees >> STP reporting''' (agents go to Business >> STP reporting). | ||

* Click the dropdown arrow next to one of your STP reports. | * Click the dropdown arrow next to one of your STP reports. | ||

* Copy the Business Management software (BMS) ID so you can paste it into the Previous Software BMS ID field in Wageloch. | * Copy the '''Business Management software (BMS) ID''' so you can paste it into the '''Previous Software BMS ID''' field in Wageloch. | ||

Latest revision as of 00:14, 22 October 2025

Connection Settings

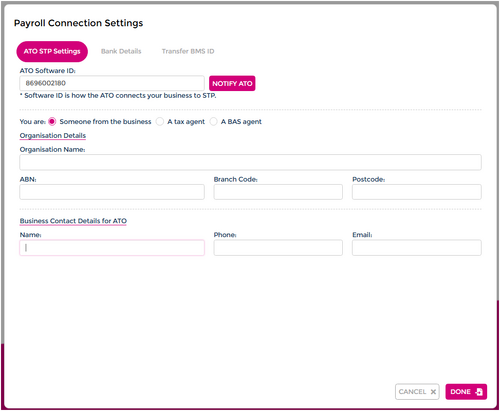

- Click the Settings cog, top right

- From the menu, select Payroll >> Payroll Connection

- Here we will see three tabs; ATO STP Settings, Bank Details, Transfer BMS ID.

All information in this area is required and cannot be left blank or skipped.

ATO STP Settings

ATO Software ID

- This is Wageloch's unique ID and will be automatically generated for you.

- Please click NOTIFY ATO

- You'll receive instructions on how to notify the ATO that your STP reporting will be completed through Wageloch Payroll.

- Follow the steps for your preferred notification method.

- Click Done to finish.

- Please select if you are:

- Someone from the business

- A tax agent

- A BAS agent

Organization Details

- Organisation Name: Enter your business or trading name

- ABN: Enter your Australian Business Number (11 digits)

- Branch Code: Typically enter 1 unless otherwise specified; this is variable if you're running multiple businesses or branches under the same ABN.

- Postcode: Enter the postcode for your suburb.

Business Contact Details for ATO

Enter the contact who will be authorizing pays to the ATO; Name, phone number and email address are required.

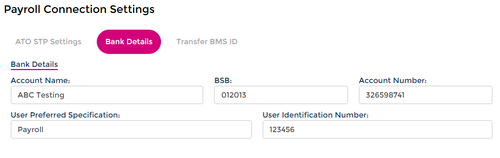

Bank Details

Inputting your bank details is super easy, and will be the existing or desired account that your wages will be paid from when we generate your ABA bank file.

- Account Name: Enter the name of your bank account as it appears on your statements

- BSB and Account Number: Enter the BSB (Bank-State-Branch). This will always be a 6 digit number that specifies your bank and branch.

- User Preferred Specification: Enter what you would like the transaction to appear as in your account.

- User Identification Number: Also known as an APCA number. This should be assigned to you by your bank to identify any transactions approved by you.

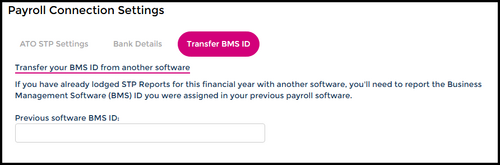

Transfer BMS ID

If you've been using another payroll system to report STP reports for the current financial year, you'll need your Business Management Software (BMS) ID.

Your BMS ID can be found in different areas in different payroll systems, but you'll likely locate this on a payroll report or through your business' ATO Portal.

- Log into the ATO's online services.

- Go to Employees >> STP reporting (agents go to Business >> STP reporting).

- Click the dropdown arrow next to one of your STP reports.

- Copy the Business Management software (BMS) ID so you can paste it into the Previous Software BMS ID field in Wageloch.