Difference between revisions of "Wageloch Payroll: How to Process Pays"

| Line 167: | Line 167: | ||

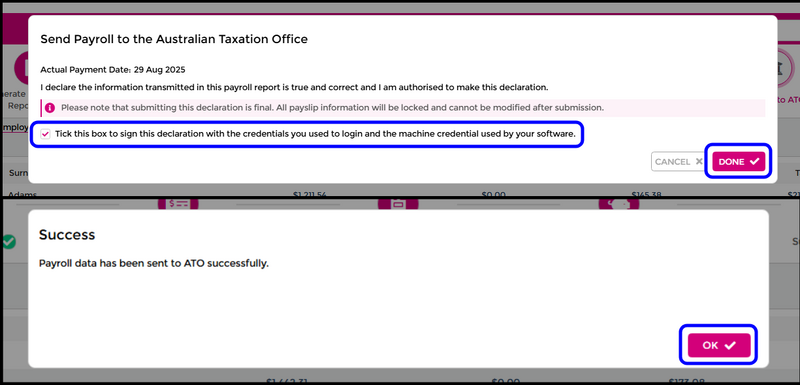

=Final Stage: Sent to ATO= | =Final Stage: Sent to ATO= | ||

To finish your payrun and report earning and tax to the ATO: | |||

* Click '''Finish''' (bottom right) or select '''Submit to ATO''' | |||

* You will receive a '''declaration prompt''', confirming the payroll report is true, correct and that you're authorised to make the declaration. | |||

* '''Tick the box*''' to add your digital signature to the declaration. | |||

* Click '''Done''' to finish your pay run and submit data to the ATO. | |||

* Click '''OK''' to finish. | |||

After finishing the entire payrun, each successful stage should show a '''green tick''' to indicate that stage has been completed. | |||

[[File:Submit-ato.png|800px]] | |||

=Creating Unscheduled Payrun= | =Creating Unscheduled Payrun= | ||

Revision as of 05:28, 31 August 2025

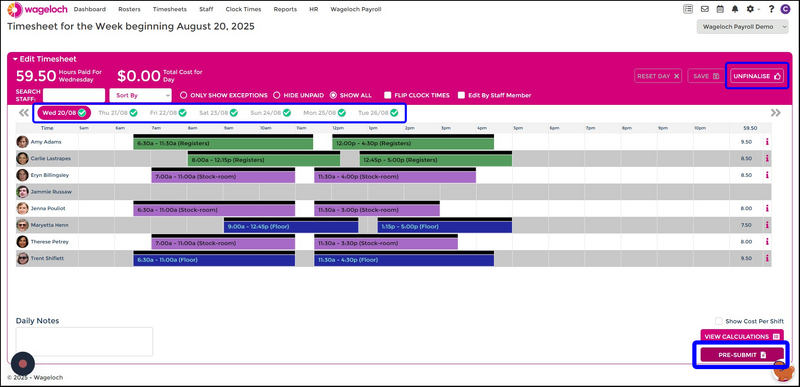

The timesheet submission process for Wageloch Payroll remains the same, whether you're a business owner completing your own payroll, or a site manager submitting timesheets to your Payroll team.

- Open your current timesheet

- Ensure all timesheet days are Finalised with a green tick

- Click Pre-Submit

- Your Pre-Submit timesheet summary report will generate

- Please check this information thoroughly.

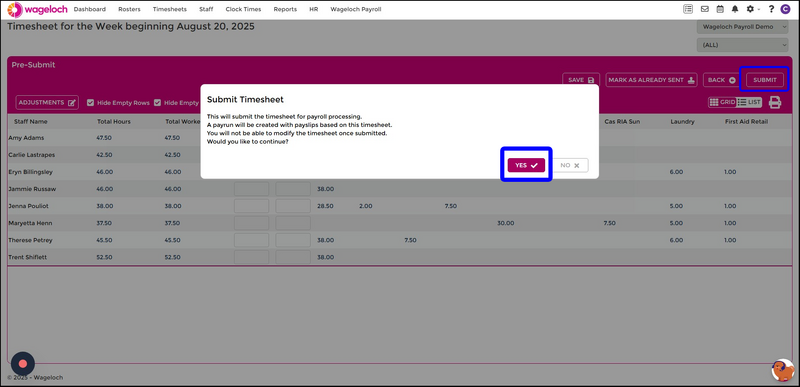

- When you're ready to proceed, click Submit.

- Confirm the prompt, acknowledging your timesheet will be submitted for processing.

- Once completed, you'll be either:

- Notified the timesheet was submitted successfully, OR

- Be redirected to Wageloch Payroll to start your submission.

Stage 1: View Calculated Pays

This screen will allow you to:

- Click the Page icon or employee's name to edit their payslip (1)

- Click the Trash icon to delete an employee from this pay run (2)

- See the summary of Gross Wages, Deductions, Superannuation, Tax and Net Pay. (3)

- Click the People icon to view the timesheet that was submitted. (4)

- At the bottom of this screen, you will have a Notes button (5).

This will grant you the ability to add a note that is visible to all staff on their payslip.

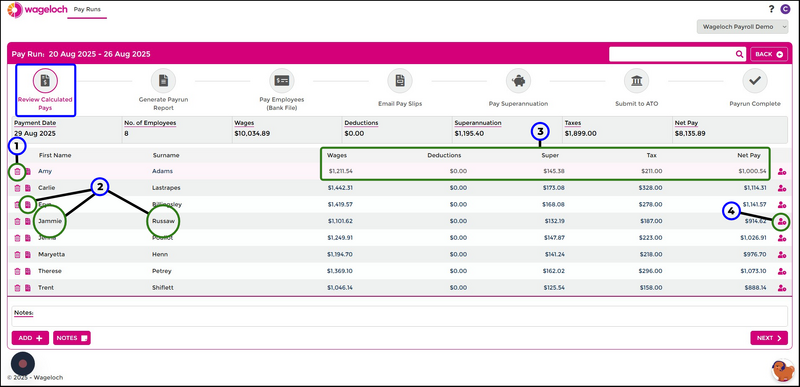

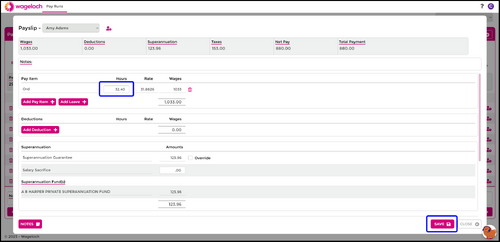

View/Adjust Pay Slip

- After clicking on the Page icon or the employee's name, you'll be presented with their payslip.

- This will show the employee's gross and net wages, alongside superannuation and tax across the top.

- You will be able to see the calculations for the employee's pays based on the hours in the timesheet and award configuration.

- Further down the page, you'll see any automated deductions, superannuation, salary sacrifice and tax withheld.

- There is an option in the bottom left to Add Note, which is only visible to this employee on their pay slip.

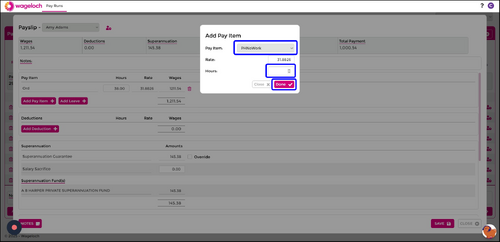

Add Pay Item or Add Leave

If you're missing some hours or need to backpay an employee, use the Add Pay Item or Add Leave buttons.

- Select the appropriate Pay Item from the drop menu

- The Rate is typically calculated by the award setup and/or the employee's hourly rate on their staff card.

- Enter the Amount of hours, units or dollars, depending on the requirement.

- Click Done to save.

- Any automatic calculations like tax will update accordingly, but you can Override if needed

- Click Save to finish

- Click Close to return to the pay run

If you wish to edit a pay item that already exists, simply adjust the **Hours** field to add or remove hours as required.

- Click Save to finish

- Click Close to return to the pay run.

- Use the Notes button, bottom left to add a unique message for this employee.

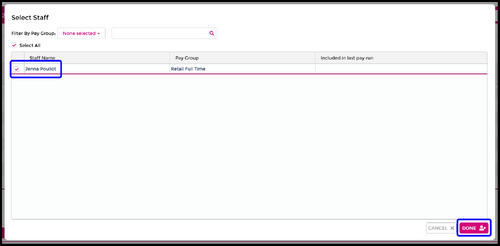

Add Employee to Payrun

- On the pay run screen, click the Add button, bottom left

- Select the employee to add into the pay run

- Click Done to add

- You'll immediately be presented with the employee's pay slip

- Proceed to add any pay items, leave, allowance and hours.

- Click Save to finish

- Click Close to return to the pay run.

[[1]]

[[1]]

Add Note for All Staff

To add a Note visible to all employees on their payslip:

- On the Pay Run screen, click the Notes button (bottom left)

- Add the message you wish to attach

- Click OK to save.

- This will now be visible at the bottom of the pay run.

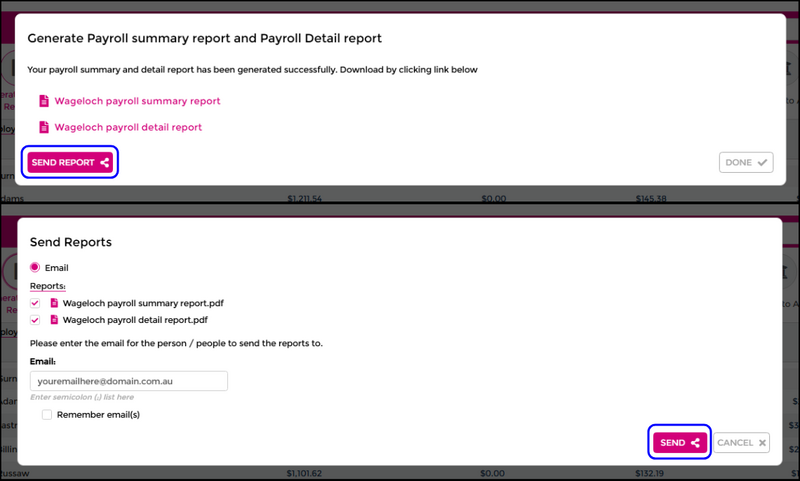

Stage 2: Generate Payrun Report

When you're ready to proceed to the next step of your pay run, either:

- Click Next, bottom right, OR click Generate Payrun Report

- You'll receive a prompt to confirm that your payslips are accurate and correct.

- Click YES if you're happy to proceed.

- Click NO if you'd like to return to the pay run and make changes.

- Once your payslips are confirmed, click Next (bottom right) to Generate Payrun Report.

- You'll be prompted to generate your Payrun Report

- This will allow you to download a Payroll Summary and a Payroll Detail report.

- Click Done after downloading the files.

- You can also email these reports by clicking Send Report and entering your email address

- Click Send.

TIP: If you have issues with the result of the timesheet export in your payrun, you can:

- Have the timesheet unsubmit by the Wageloch Helpdesk

- Make any adjustments to the timesheet

- Click **Submit** to sent the timesheet through to Wageloch Payroll

- This will overwrite any information in the pay run.

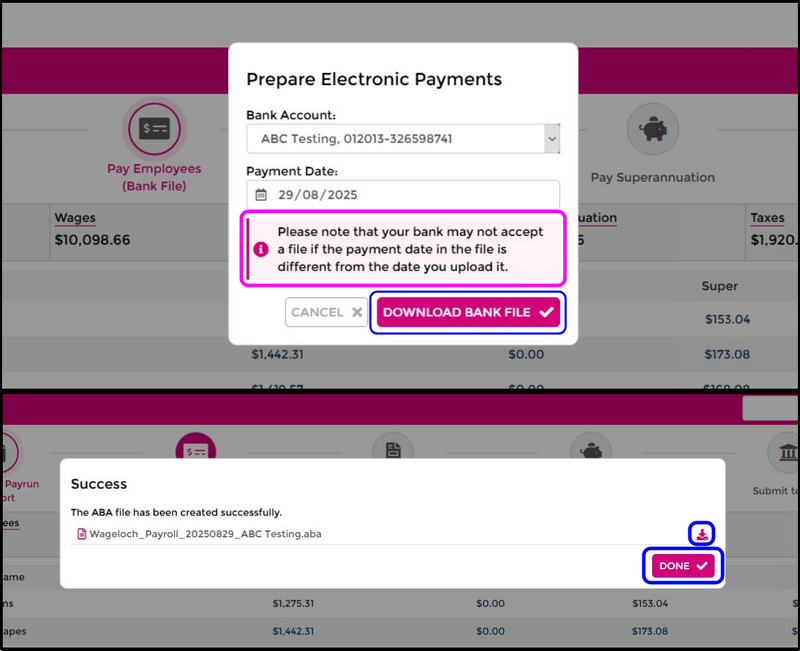

Stage 3: Create ABA Pay File

Your next step generates the ABA file to send to your banking institution.

- On the Generate Payrun Report page, click Next (bottom right) or click Pay Employees (Bank File)

- A box will appear, prompting for your nominated bank account and the desired payment date.

- Click Download Bank File.

- Click the file to download it.

- Click Done to finish.

NOTE: Your bank may not accept a file if the payment date is different from the date you upload it.

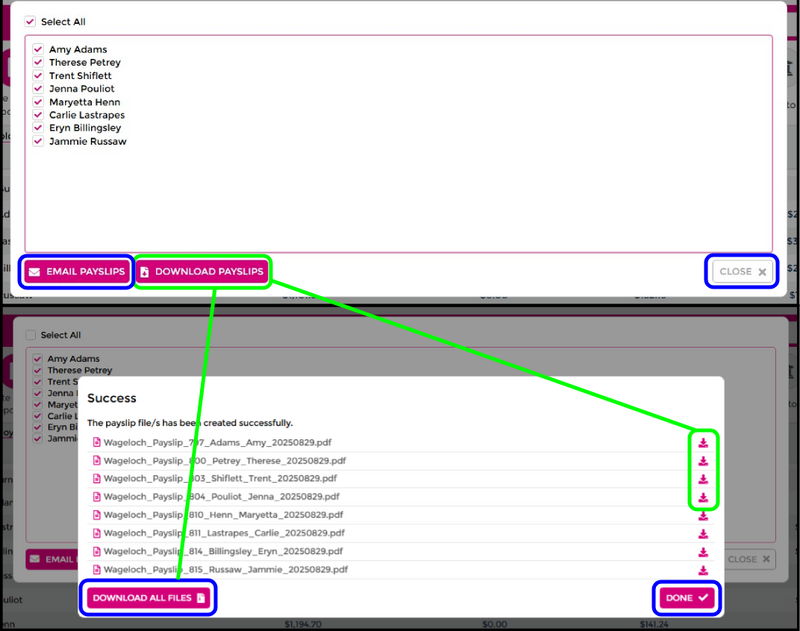

Stage 4: Email Payslips

- Click Next (bottom right) or select Email Pay Slips

- Select the employees that you wish to email payslips to.

- Click Email Payslips (bottom left).

- Once sent, you'll receive a prompt confirming the payslips have been sent succesfully.

- Close Close to finish.

If you wish to download the payslips to print off or keep for your records:

- Click Download Payslips.

- Click individual files to download one-by-one, OR

- Click the Download All Files button.

- Click Done when finished to continue.

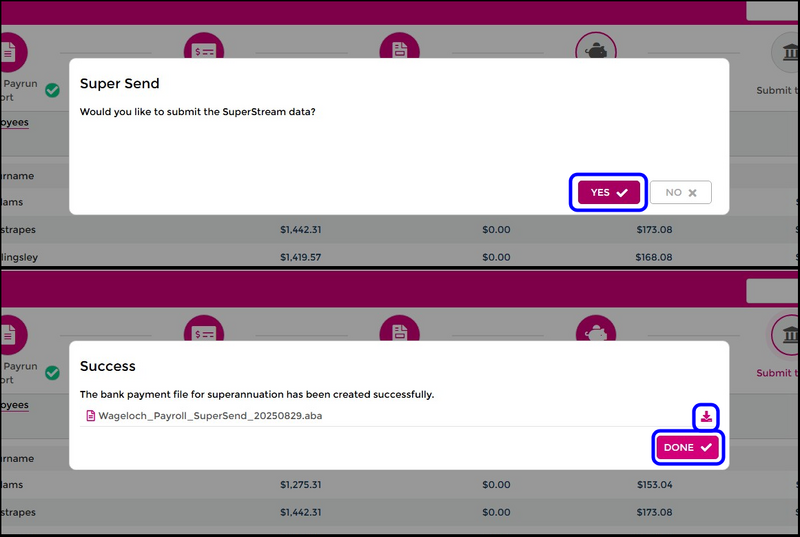

Stage 5: Generate Super ABA File

To generate your Superannuation ABA file for this single pay run:

- Click Next (bottom right) or select Pay Superannuation.

- A prompt asking if you'd like to submit your SuperStream data will appear

- Click YES to generate your Superannuation ABA file

- Click NO to generate your ABA file later

- Click the file to download your SuperStream ABA file.

- Click Done to finish.

TIP: See step on Paying Super for Multiple Payruns to generate a superannuation ABA file for more than one pay.

Final Stage: Sent to ATO

To finish your payrun and report earning and tax to the ATO:

- Click Finish (bottom right) or select Submit to ATO

- You will receive a declaration prompt, confirming the payroll report is true, correct and that you're authorised to make the declaration.

- Tick the box* to add your digital signature to the declaration.

- Click Done to finish your pay run and submit data to the ATO.

- Click OK to finish.

After finishing the entire payrun, each successful stage should show a green tick to indicate that stage has been completed.